philadelphia transfer tax regulations

120647 approved January 20 2014 and effective July 1 2015. Effective July 1 2017 Philadelphia law changed.

Pennsylvania Cuts Corporate Net Income Taxes After 27 Years Philadelphia Business Journal

The Realty Transfer Tax applies to the sale or transfer of real estate located in Philadelphia.

. Philadelphia Code 19-1405 Under the new provision a 75 change in ownership will be deemed to have occurred if within six years of one or more prior transfers. 567 approved June 5 1985 and Bill No. The tax becomes payable when a property deed or other document showing realty ownership is filed with the Records Department.

Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. The Transfer Tax is imposed on the propertys sale price or assessed value plus any debts liens or judgments the. 1259 approved June 11 1987 These regulations have been.

However this is not always the same as the sales price. Since AVI the Philadelphia CLRF has been close to 100. CITY OF PHILADELPHIA REAL ESTATE TRANSFER TAX REGULATIONS Preface The Philadelphia Realty Transfer Tax wa s imposed by Ordinance of City Council approved 1952 codified as Chapter 19-1400 amended by Bill No.

Electronic version of The Philadelphia Code and Home Rule Charter is current through June 21 2022. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 526 rows AMENDMENT TO THE REAL ESTATE TRANSFER TAX REGULATIONS.

Instead of imposing Philadelphia Realty Transfer Tax when a real estate company experienced a 90 percent or more change in ownership in a three-year period transfer tax is imposed when a real estate company experiences a 75. Long-term leases 30 or more years Easements. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now.

Department of Public Health. Effective July 1 2017 a real estate company is treated as an acquired real estate company and owes Philadelphia transfer tax upon a 75 or more change of ownership in the company within a six-year period. Theres also a 327 Philadelphia Realty Transfer Tax to take care of in addition to a 1 tax from the Commonwealth.

In a corporate dissolution there is no realty transfer tax on the transfer of realty from the corporation to the trustees for the stockholders. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term lease or other writing. 7 rows The regulations document puts forth the legal terms of Philadelphias.

This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is filed with the Record of Deeds. Subcode PM was further amended and its substantive provisions replaced in their entirety by. 1259 approved June 11 1987 These regulations have been.

It has changed the ownership interest that will trigger the transfer tax from 90 to 75 with a six year waiting period. Common transactions that are excluded from real estate transfer tax include. Sugar-Sweetened Beverage Tax Regulationspdf.

Previously a real estate company owed Philadelphia transfer tax upon a 90 or more change of ownership within a three-year period. Fortunately it is common but not legally obligatory for the buyer and seller to share the transfer taxes equally between the two parties. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

And currently it is 101. Philadelphias new ordinance seeks to close the loophole for 8911 transactions. REAL ESTATE TRANSFER TAX REGULATIONS Preface The Philadelphia Realty Transfer Tax was imposed by Ordinance of City Council approved 1952 codified as Chapter 19-1400 amended by Bill No.

Complete the correct certificate and submit it when you record the deed or mail in your Realty Transfer Tax. Real Estate Transfer Tax certificates. 567 approved June 5 1985 and Bill No.

Tax on the Transfer of Real Estate There is a 2 percent Transfer Tax on all property sales in Pennsylvania 1 percent to the state and 1 percent to the municipality and school district based on the value of the property or interest that is being transmitted. Transfers to an excluded party by gift or dedication confirmation deeds correctional deeds transfers between certain relatives transfers between certain non. Documents showing ownership include.

Amendment to the Real Estate Transfer Tax Regulation 12-10-21pdf. Subcode PM was repealed and replaced by Bill No. When you complete a sale or transfer of real estate that is located in Philadelphia you must file and pay the Realty Transfer Tax.

Deed transfers and entity transfers have their own unique forms. Philadelphia Beverage Tax Regulations - Amendments to Section 101 and 401. This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is filed with the Record of Deeds.

Transfer Tax on Real Estate One percent is collected by the Commonwealth of Pennsylvania while 3278 percent is collected by the City of Philadelphia for a combined total of 4278 percent. 233 409 A2d 326 328 1979. Philadelphia transfer tax law excludes 28 transactions while Pennsylvania transfer tax law excludes 34 transactions.

Both grantor and grantee are held jointly and severally liable for.

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

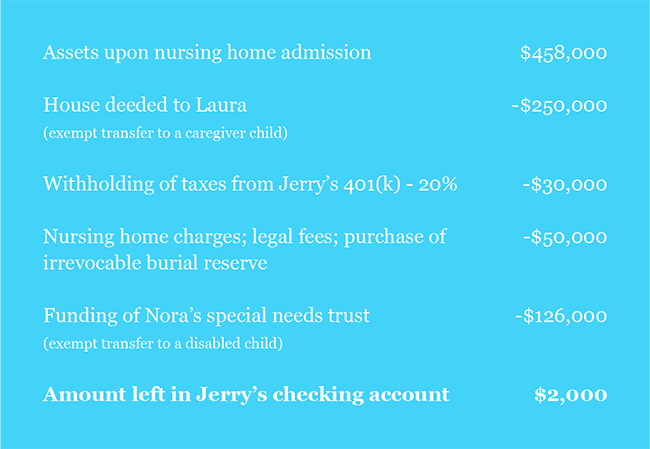

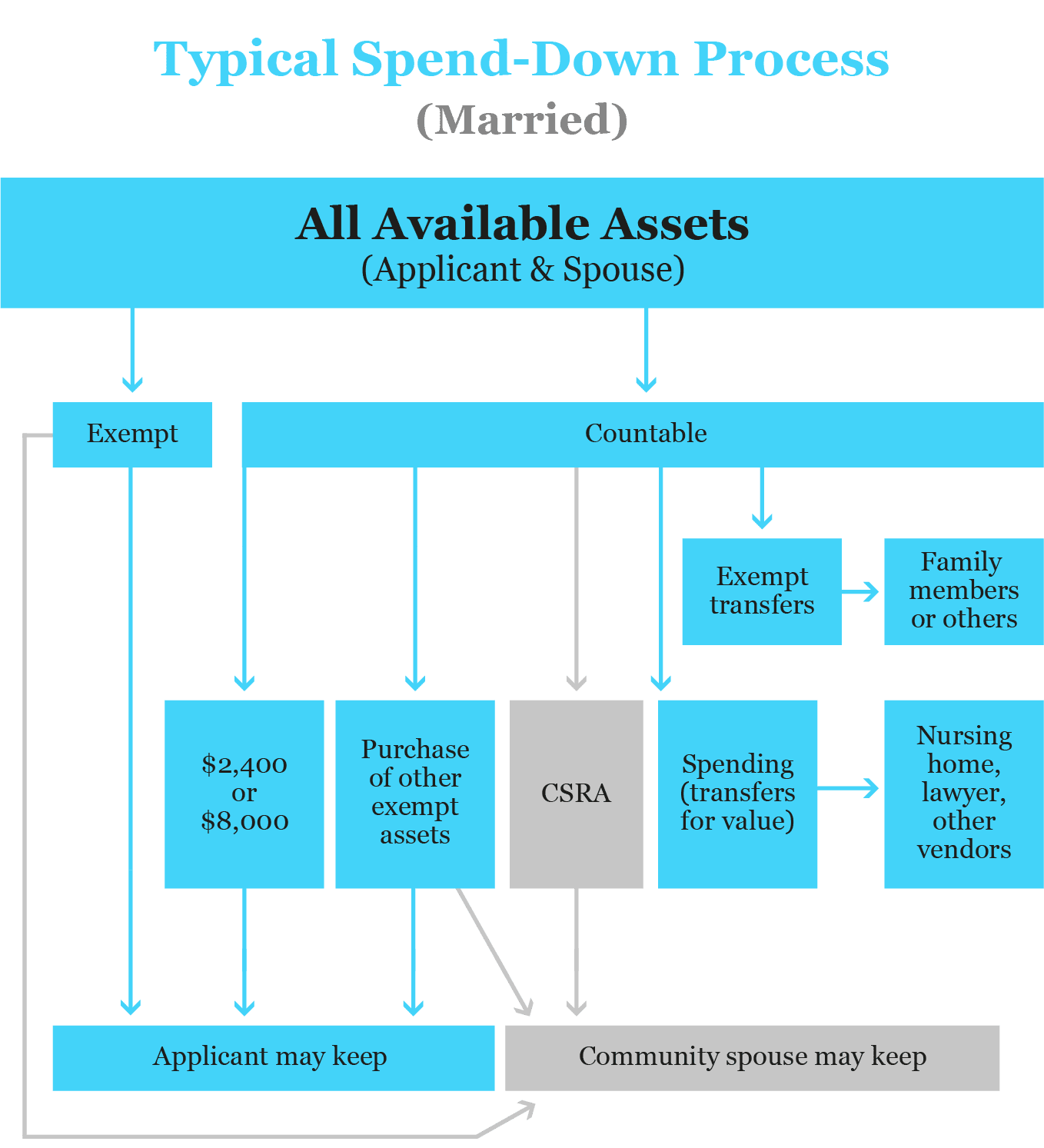

How To Spend Down To Qualify For Medicaid Eligibility In Pa

Like Kind Exchanges Of Real Property Journal Of Accountancy

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Like Kind Exchanges Of Real Property Journal Of Accountancy

What You Need To Know About Philadelphia S Tax Abatement Program The Legal Intelligencer

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp

How To Spend Down To Qualify For Medicaid Eligibility In Pa

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

Jeannieborin On Twitter Yahoo News Sayings Finance

Pennsylvania Property Tax H R Block

Philadelphia Real Estate Market Crunched By Low Home Supply And Price Inflation Will See The Return Of 10 000 Grants For First Time Buyers Phillyvoice